do you pay taxes on inheritance in colorado

How much tax do you pay on inheritance. Thats because federal law doesnt charge any.

Colorado Uniform Trust Code Notice To Beneficiaries Hammond Law Group

Colorado Form 105 Colorado Fiduciary Income Tax Return is the Colorado form for estate income taxes.

. How does inheritance tax work for Colorado residents. There is no federal inheritance tax but there are a handful of states that impose state level. However because this is an information return and not a tax.

This form applies in cases where a US. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. There is no federal inheritance tax but there is a federal estate tax.

The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount. Person receives more than 100000 through a foreign inheritance or gift. A state inheritance tax was enacted in Colorado in 1927.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. An inheritance tax is a tax on the property you receive from the decedent. Colorado Inheritance Tax and Gift Tax.

In other words when an. Inheritances that fall below these exemption amounts arent subject to the tax. Our free Colorado paycheck calculator can help figure out what your take home pay in the Centennial State will be.

But Colorado residents are lucky to live in a state that no longer collects estate taxes. First estate taxes are only paid by the estate. If it does its up to.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. There is no federal inheritance tax. Colorado Form 105 Colorado Fiduciary Income Tax.

The good news is that since 1980. Until 2005 a tax credit was allowed for federal estate. This gift-tax limit does not refer to the total amount you.

How much tax do you pay on inheritance. Colorado Form 105 Colorado Fiduciary Income Tax Return is the Colorado form for estate income taxes. It happens only if they inherit an.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Inheritance taxes are taxes that apply directly to any property you receive as an inheritance. The first rule is simple.

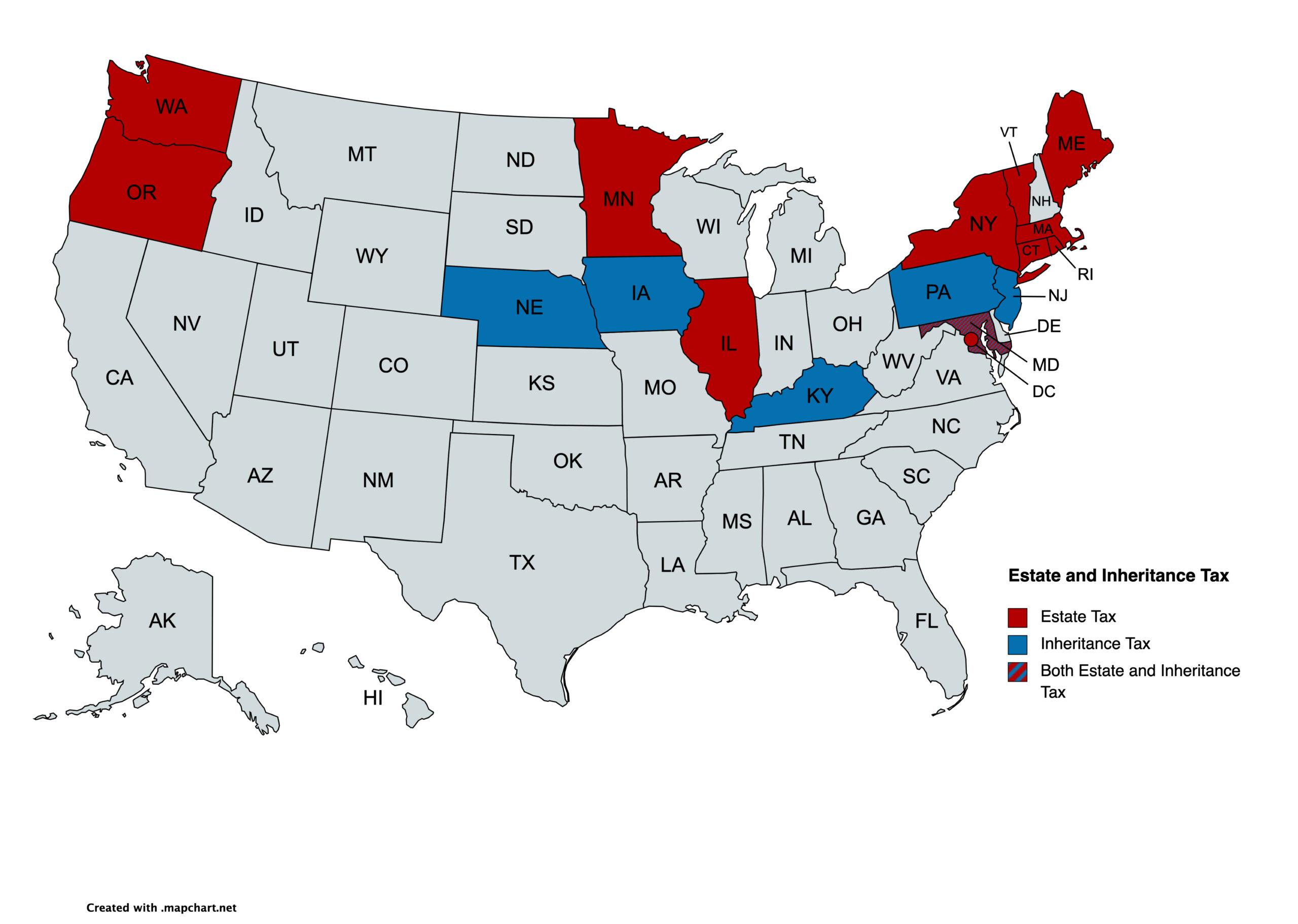

Inheritance tax is a tax paid by a beneficiary after receiving inheritance. Again Colorado is not one of the states. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

After you die someone will become responsible for taking over your estate and determining whether it owes any estate taxes. Technically there is only one case where a Colorado resident would have to pay an inheritance tax. If you receive property in an inheritance you wont owe any federal tax.

Changes stemming from the Economic Growth and Tax Relief Reconciliation Act of 2001 were. This really depends on the individual. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received.

Colorado Ira Inheritance Planning Ball Barry Law

Colorado Springs Intestate Succession Lawyer Patterson Weaver Law Llc

Wills Trusts And Estate Planning In Denver Colorado Springs Co Leventhal Lewis

States With No Estate Tax Or Inheritance Tax Plan Where You Die

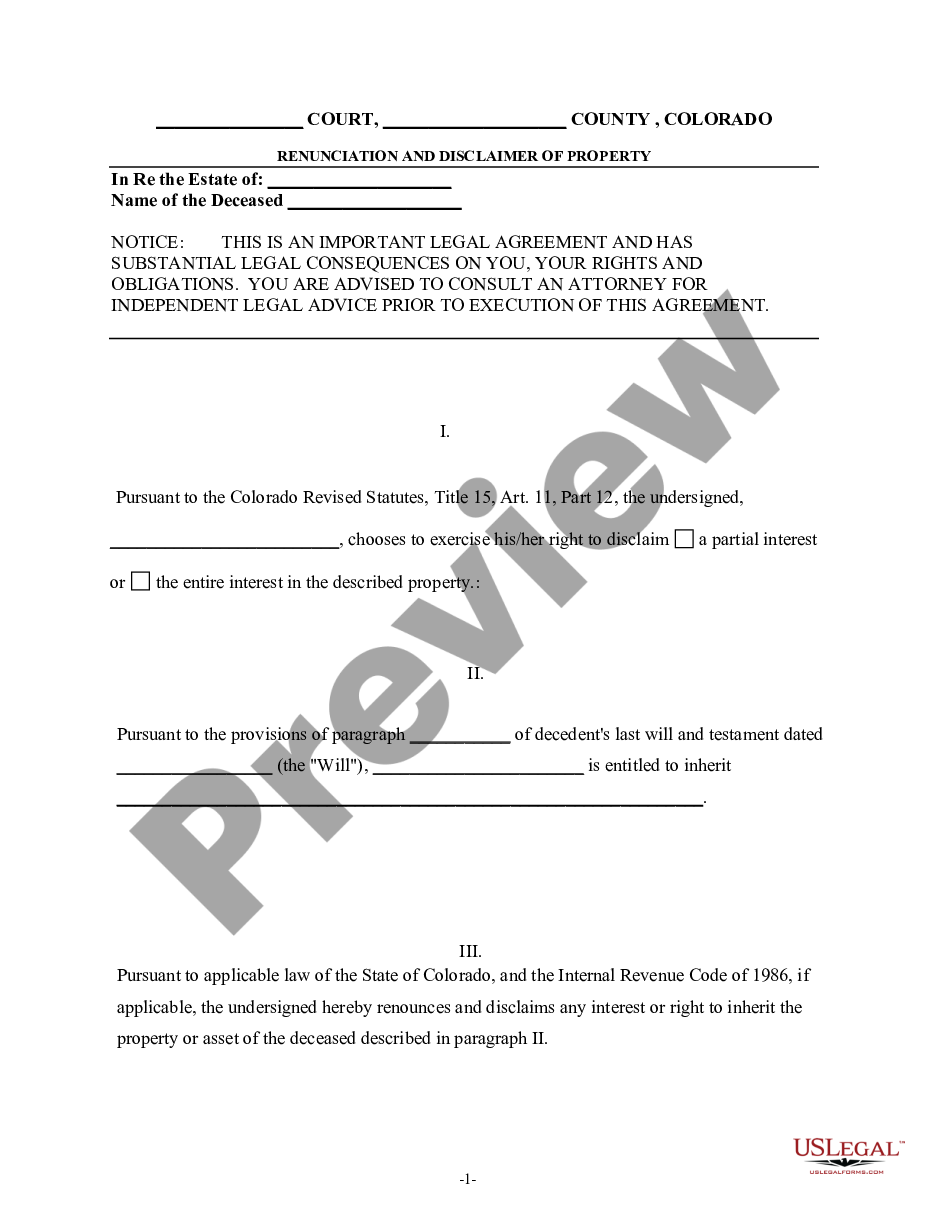

Colorado Renunciation And Disclaimer Of Property From Will By Testate Sample Letter Of Disclaimer Of Inheritance

How Much Is Inheritance Tax Community Tax

Inheritance Tax Checklist Know Before You Sell Sensible Money

Colorado Renunciation And Disclaimer Of Property From Will By Testate Sample Letter Of Disclaimer Of Inheritance

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

State By State Comparison Where Should You Retire

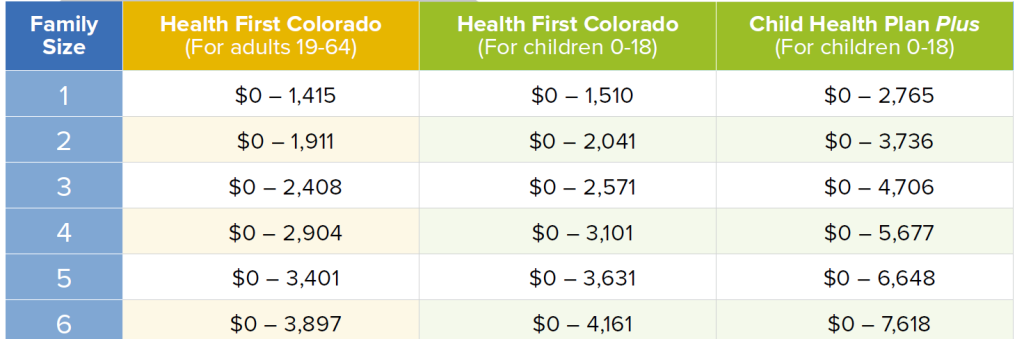

Are You Eligible For A Subsidy

What Are The Do S And Don Ts Of Estate Planning In Colorado Law Office Of Skipton Reynolds Llc

Inheriting Real Estate In Colorado

Colorado Last Will And Testament Legalzoom

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

:max_bytes(150000):strip_icc()/Coloradoflag-Fotosearch-GettyImages-124279649-56acc76f3df78cf772b64e4e.jpg)